Under the environmental protection needs of clean energy, it is iterated from gasoline to lithium battery OPE

At present, the market is still dominated by gasoline-powered equipment, and the penetration rate of lithium battery equipment is low. Gasoline OPE entered the market from the beginning of the 20th century, and in recent years, due to the upgrading of lithium battery technology and the decline in product costs, lithium battery OPE has only begun to emerge in the market, so the current lithium battery OPE penetration rate is low. According to Frost & Sullivan, the market size of fuel-powered/corded/cordless/parts & accessories was $166/11/36/3.8 billion in 2020, accounting for 66%/4%/14%/15% of the overall market share, respectively.

We believe that changes in the demand side will promote the rapid increase in lithium battery penetration rate for the following reasons:

(1) From the perspective of product performance, lithium battery equipment is more environmentally friendly, operating and maintenance cost, safety and ease of use than fuel equipment. Traditional fuel-powered products have low energy utilization, serious heat energy loss, and the exhaust gas generated by the lack of exhaust gas treatment devices will cause serious pollution to the atmosphere. According to CARB data, using an hour's gasoline-powered lawn mower is equivalent to the exhaust emissions of a car driving 300 miles from Los Angeles to Las Vegas. Lithium battery products have excellent product characteristics such as clean and environmental protection, low noise, low vibration, simple maintenance and low operating costs. According to OPEI data, fuel OPE equipment needs to use gasoline with an ethanol content of less than 10%, otherwise it will cause damage to the equipment, and the advantages of lithium battery products may gradually become prominent in the context of chaotic fuel market supply, continuous increase in oil prices, and rising costs of fuel equipment. For residential users with a small operating area, low noise, safety and ease of use, lithium battery OPE may be a better choice, according to Husqvarna survey, 78% of respondents believe that environmentally friendly OPE should be used.

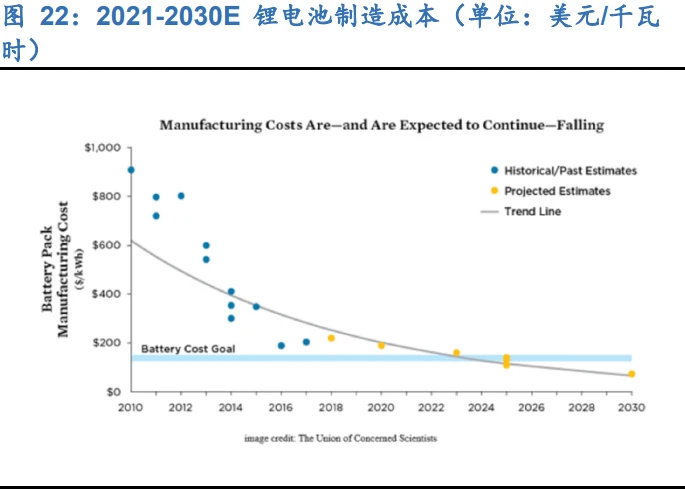

(2) From the perspective of the existing shortcomings of products, the upgrading of lithium battery technology and the decline in the price of lithium battery products will break through the existing disadvantages. According to Amazon data, the common walk-behind lithium battery mower costs $300-400, the 40V 4.0ah battery can run for 45 minutes on a single charge, the fuel mower price is $200-300, and the plus 0.4 gallon oil can run for 4 hours. With the development and upgrading of lithium battery technology, the cathode material is gradually replaced by a high-nickel ternary with higher energy, and a silicon-based anode technology reserve with stronger safety performance and rate performance is established, and while the performance of lithium battery is improved, the cost of positive and negative electrode materials that account for more than half of the cost of lithium batteries will also decrease accordingly. According to the 2021 Lithium-ion Battery Pack Price Survey, the average price of battery packs is expected to fall below $100/kWh by 2024. We believe that with the continuous progress of lithium battery technology, battery life and manufacturing cost restrictions are gradually broken, lithium battery OPE products will continue to be popularized and recognized by users, and the market penetration rate is expected to increase year by year.

(3) From the perspective of policy drive, environmental protection policies are the catalyst to accelerate the replacement of fuel equipment by lithium-ion batteries. Since 2008, the U.S. Environmental Protection Agency (EPA) has implemented the most stringent Tier 4 U.S. vehicle emissions standards, which regulate the environmental protection of OPE products such as lawn mowers, chainsaws, and leaf blowers. According to the U.S. Environmental Protection Agency, OPE generated 26.7 million tons of air pollutants in 2011, accounting for 24%-45% of non-road gasoline emissions, and California and four other states (the top five populous in 2011) together accounted for more than 20% of total U.S. emissions. In 2021, California banned gasoline-powered equipment with small off-highway engines, including gasoline-powered generators, pressure washers, and lawn tools such as leaf blowers and lawn mowers, starting in 2024, and several regions including New York and Illinois are considering similar measures to achieve a carbon-free economy. At the same time, organizations such as the American Alliance of Green Zones (AGZA) are preparing steps to help outdoor-focused companies and municipalities transition from gas-powered small equipment, including training on EPA and CARB compliant equipment and battery electric options. In Europe, OPE products are also regulated by European emission standards, which have progressively gone through 5 stages since 1999, while the most stringent Phase 5 standards have been gradually implemented since 2018 and fully implemented from 2021. Increasingly stringent regulatory requirements have accelerated the OPE industry's development of new energy power, contributing to the development of OPE lithium batteries worldwide.

(4) From the perspective of supply-side guidance, core enterprises actively guide the transformation of consumer demand. Power tool market core companies TTI, Stanley Baltur, BOSCH, Makita and others are actively expanding their lithium battery product platforms to drive sustainability by addressing the inherent problems of gasoline-powered products and transitioning to lithium battery products. For example, Husqvarna's proportion of electric power products in 2021 was 37%, an increase of 26pcts over 2015, and plans to increase to 67% in the next 5 years; Stanley Baltur acquires MTD to enter the field of lithium-ion outdoor power equipment; TTI plans to launch 103 cordless outdoor products in 2022, its RYOBI plans to launch 70 new OPE products in 2022, and Milwaukee plans to launch 15 new products. According to our statistics on the official websites of companies and channels, as of March 2022, the proportion of fuel OPE equipment of core companies Innovation and Technology Industries, Stanley Baltur and Makita in the total OPE products was only 7.41%, 8.18% and 1.52% respectively; The core channels Lowe's, Wal-Mart, and Amazon's fuel lawn mower products are also below 20%, and core companies are actively increasing the supply of lithium battery equipment to guide consumer demand from fuel equipment to lithium battery equipment.

Post time: Mar-13-2023